For decades, proving that a generic drug works the same as the brand-name version meant putting healthy volunteers through blood draws, frequent dosing, and weeks of monitoring. These in-vivo bioequivalence studies cost up to $2 million each and took months to complete. But now, a smarter approach is changing the game: in-vitro testing that predicts how a drug behaves inside the human body - without ever needing a human subject.

What Is IVIVC, and Why Does It Matter?

IVIVC stands for In Vitro-In Vivo Correlation. It’s not magic. It’s science. At its core, IVIVC links lab-based dissolution tests - how quickly a pill releases its drug in a test tube under controlled conditions - to what actually happens in the human body: how much drug enters the bloodstream, how fast, and how long it lasts.

The U.S. Food and Drug Administration (FDA) first recognized IVIVC as a valid regulatory tool in 1996. Since then, it’s become the gold standard for skipping unnecessary clinical trials - especially for complex drug forms like extended-release tablets or capsules. If you can prove that your pill dissolves the same way as the brand-name version, and you’ve built a solid mathematical model showing that this directly predicts blood levels, you can ask for a biowaiver. That means no more human studies. Just dissolution data.

This isn’t theoretical. In 2022, the FDA approved 42% of IVIVC submissions - up from just 15% in 2018. That’s not luck. It’s better science.

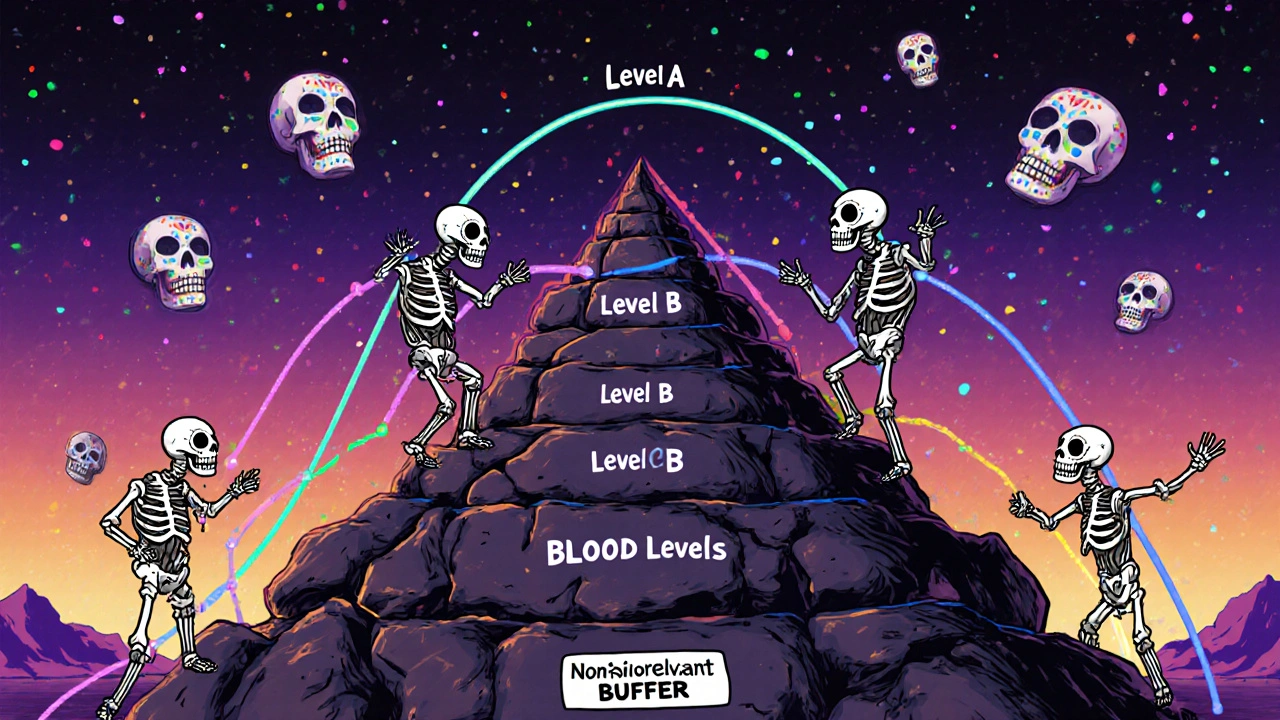

The Four Levels of IVIVC: Not All Correlations Are Created Equal

Not every IVIVC model is powerful enough to earn a waiver. The FDA classifies them into four levels, and only some will get you out of clinical trials.

- Level A is the holy grail. It’s a point-to-point match between dissolution at every time interval and drug absorption in the body. Think of it like a perfect mirror: if your tablet dissolves 30% at 1 hour, 60% at 4 hours, and 90% at 8 hours, the blood concentration follows that exact pattern. To qualify, the model needs an R² value above 0.95, a slope near 1.0, and an intercept near zero. Predictions must be within ±10% for total exposure (AUC) and ±15% for peak concentration (Cmax). Only Level A gets you a full biowaiver for most changes.

- Level B uses averages - like comparing the average time it takes for the drug to dissolve to the average time it stays in the blood. It’s useful, but it can’t predict individual profiles. Not enough for a waiver.

- Level C ties a single dissolution number - say, 80% dissolved at 2 hours - to a single PK number, like Cmax. It’s easier to build, but it only tells you about one part of the story. The FDA sometimes accepts multiple Level C correlations if you back them up with extra data.

- Multilevel C is when you link several dissolution points to multiple PK parameters. It’s more robust than single Level C, but still not as reliable as Level A.

Bottom line: if you want a waiver, aim for Level A. Everything else is a gamble.

When Does IVIVC Actually Work?

IVIVC isn’t a one-size-fits-all solution. It works best for certain types of drugs - and fails badly for others.

It shines with extended-release oral products. Think opioid painkillers, ADHD medications, or heart drugs that need to last 12 or 24 hours. These are hard to get right. Small changes in formulation can make the drug release too fast or too slow. IVIVC lets you tweak the recipe without running a new human study every time. The FDA’s SUPAC-MR guidance (1997) says you can use IVIVC to justify changes like moving manufacturing sites, adjusting excipients by up to 5%, or scaling up production - as long as your dissolution profile stays within f2 similarity factor >50.

But it doesn’t work well for:

- Narrow therapeutic index drugs - where even tiny differences in blood levels can cause toxicity or treatment failure (like warfarin or lithium).

- Drugs with nonlinear absorption - where doubling the dose doesn’t double the blood level.

- Drugs absorbed in the colon or with complex transporters - where dissolution in the stomach doesn’t tell you much.

- Injectables, ophthalmics, or implants - though the FDA is now exploring IVIVC for these in draft guidance (2023).

For simple immediate-release tablets, the Biopharmaceutics Classification System (BCS) is often the easier route. If your drug is highly soluble and highly permeable (BCS Class I), you might skip IVIVC entirely and just use dissolution standards.

The Hidden Cost of Failure

IVIVC sounds like a cost-saver - and it is. Avoiding one bioequivalence study can save $1-2 million and 6-12 months of development time. But building a valid IVIVC isn’t cheap or easy.

According to industry surveys, 68% of generic companies have tried to develop an IVIVC. Only 29% got approved on the first try. Why so many failures?

- 76% didn’t test enough formulations - you need at least 3-5 versions with different release rates to build a reliable model.

- 63% used dissolution methods that couldn’t tell the difference between good and bad batches.

- 52% didn’t collect enough blood samples from volunteers - you need dense PK data (at least 12 time points per subject) to see the full absorption curve.

One company spent $1.2 million over 18 months on an IVIVC for a modified-release drug - only to see it fail when food effects changed the absorption pattern. Another, Teva, spent 14 months and three formulation tries before getting FDA approval for an extended-release oxycodone generic. But once approved, it saved them five full bioequivalence studies for future changes.

Contract labs like Alturas Analytics and Pion report 60-70% success rates - but only when they’re brought in early. Companies that wait until the end of development to try IVIVC almost always fail.

What Makes a Good Dissolution Method?

It’s not just about running a test. It’s about running the right test.

Traditional dissolution uses simple buffers at pH 6.8. But the stomach isn’t pH 6.8. It’s acidic. And the small intestine? Full of bile salts and enzymes. That’s why biorelevant dissolution is now essential.

Biorelevant media mimic real gastrointestinal conditions. For example:

- Fasted-state simulated intestinal fluid (FaSSIF)

- Fasted-state simulated gastric fluid (FaSSGF)

- Fasted-state simulated intestinal fluid with bile salts (FeSSIF)

These aren’t optional anymore. The FDA’s 2023 review of 127 IVIVC submissions found that 64% failed because the dissolution conditions didn’t reflect real human physiology. If your test doesn’t simulate the gut, it won’t predict what happens in the body.

Apparatus matters too. USP Apparatus 1 (basket) or 2 (paddle) are standard. But for pellets or multiparticulates, you might need a flow-through cell. The method must be discriminatory - able to detect even 10% changes in critical formulation variables.

Who’s Doing It Right?

IVIVC isn’t for every company. Only five of the top ten generic manufacturers - Teva, Mylan, Sandoz, Sun Pharma, and Lupin - have dedicated IVIVC teams. Why? Because it takes expertise.

You need people who understand:

- Pharmacokinetics

- Dissolution mechanics

- Statistical modeling

- Physiological drug absorption

Most pharmaceutical companies don’t have this in-house. That’s why contract research organizations (CROs) are booming. The global dissolution testing equipment market hit $487 million in 2022 and is growing at 6.2% per year.

And it’s not just about equipment. The American Association of Pharmaceutical Scientists (AAPS) has offered certification programs since 2015. You need an advanced degree - and at least two to three years of hands-on experience - to even begin.

The Future: AI, Machine Learning, and Beyond

IVIVC is evolving. In 2024, the FDA and EMA held a joint workshop on machine learning-enhanced IVIVC models. Instead of manually fitting curves, algorithms now analyze thousands of dissolution and PK datasets to find hidden patterns.

These models can predict how a drug will behave under different pH levels, with food, or in elderly patients - without running new trials. They’re faster. More accurate. But they’re also harder to explain to regulators.

The FDA’s message is clear: transparency matters. You can’t use a black box. You have to show your math, your data, your assumptions.

By 2027, McKinsey & Company predicts IVIVC-supported waivers will make up 35-40% of all modified-release generic approvals - up from 22% in 2022. The EMA’s 2021 reflection paper shows 23% of scientific advice requests now involve IVIVC. Demand is rising.

And biorelevant dissolution? By 2025, the AAPS forecasts it will be standard in 75% of new IVIVC submissions.

Is IVIVC Right for Your Product?

If you’re developing a complex extended-release tablet, capsule, or pellet - yes. If you’re making a simple immediate-release tablet of a BCS Class I drug - maybe not. Use the BCS biowaiver instead.

Ask yourself:

- Is the drug’s absorption predictable from dissolution?

- Can you test at least 3-5 different formulations?

- Do you have access to pharmacokinetic data with dense sampling?

- Can you afford to invest 12-18 months and $500K-$1.5M before seeing results?

- Are you prepared to defend your model with full transparency?

If you answered yes to most of these, IVIVC could save you millions. If not, stick with traditional bioequivalence studies - for now.

IVIVC isn’t about replacing science. It’s about replacing guesswork with data. And that’s what regulators - and patients - want.

What is the main benefit of using IVIVC for generic drug approval?

The main benefit is avoiding costly and time-consuming human bioequivalence studies. A validated Level A IVIVC allows manufacturers to use dissolution testing alone to prove a generic drug behaves the same as the brand-name version, saving $1-2 million per study and cutting development time by 6-12 months.

Why do most IVIVC submissions get rejected by the FDA?

Most rejections happen because the dissolution method doesn’t reflect real human physiology. The FDA found that 64% of failed submissions used non-biorelevant media - like simple buffer solutions - instead of fluids that mimic stomach and intestinal conditions. Other common reasons include insufficient formulation variation and poor model validation.

Can IVIVC be used for all types of drugs?

No. IVIVC works best for extended-release oral products with predictable absorption. It’s not suitable for drugs with narrow therapeutic indices (like warfarin), nonlinear pharmacokinetics, or complex delivery systems like injectables or implants - unless specific validation data is available. For simple immediate-release tablets, the BCS biowaiver is often a better option.

What is the difference between Level A and Level C IVIVC?

Level A provides a point-to-point correlation between every dissolution time point and the corresponding drug absorption rate in the body - allowing full prediction of the pharmacokinetic profile. Level C only links a single dissolution value (like % dissolved at 1 hour) to a single PK parameter (like Cmax). Level A is required for full biowaivers; Level C may be accepted only with additional supporting evidence.

How long does it take to develop a valid IVIVC model?

Developing a Level A IVIVC typically takes 12-18 months. This includes 3-6 months to develop a discriminatory dissolution method, 6-9 months to run pharmacokinetic studies across multiple formulations, and 3-6 months to build and validate the mathematical model. Starting early in development significantly increases success rates.

Is IVIVC used outside the U.S.?

Yes. The European Medicines Agency (EMA) accepts IVIVC under its Bioequivalence Guideline (CPMP/EWP/QWP/1401/98 Rev. 1/Corr 2). Both the FDA and EMA now encourage biorelevant dissolution testing and are exploring machine learning models. Approval rates vary by region and product type, but global interest is rising, with 23% of EMA scientific advice requests now related to IVIVC.

14 Comments

Parv Trivedi November 16, 2025

Finally, someone explains IVIVC in a way that doesn’t sound like a textbook. This is huge for generic drug access - especially in developing countries where every dollar saved means more patients get treated. Long live smart science over brute-force trials.

kanishetti anusha November 18, 2025

Really appreciate how you broke down the levels - I’ve seen so many teams chase Level C and wonder why they got rejected. Level A is the real win. Also, biorelevant media isn’t optional anymore. If your dissolution test doesn’t mimic the gut, it’s just fancy noise.

roy bradfield November 19, 2025

Let me guess - Big Pharma pushed this so they can keep their brand-name prices high while letting generics slip through the cracks with ‘scientific’ loopholes. IVIVC? More like IV-IV-IV (Invisible, Vague, Invisible). They’ll say it’s ‘validated’ but you know they’re hiding something. Remember when they said thalidomide was safe? Same playbook. They’ll call it innovation until someone gets hurt - then it’s ‘unforeseen variable.’

Patrick Merk November 20, 2025

Love this breakdown - especially the part about contract labs stepping in. I’ve seen startups try to DIY IVIVC and end up wasting a year. The real MVPs? The CROs who’ve done 50+ models and know exactly which dissolution apparatus to use for pellets. Also, shoutout to Teva - they’re the quiet giants making this work.

Liam Dunne November 21, 2025

Just worked on an oxycodone ER project last year. Took 15 months. Failed twice. Third time? Level A. FDA approved. Saved $1.8M. The key? We started dissolution method development *before* the final formulation. Most teams wait till the end. That’s why 70% fail. Early = success.

Jamie Watts November 21, 2025

Wow so you're telling me we can skip human trials? Sounds like a scam. Who's to say the drug won't behave differently in someone with a bad gut? Or a diabetic? Or a 70-year-old? They're just replacing real people with lab jargon. This is how we get another Vioxx. You think the FDA's really checking this stuff or just rubber stamping it because Big Pharma pays their salaries?

John Mwalwala November 22, 2025

Biorelevant media is non-negotiable - FaSSIF/FeSSIF are the new gold standard. Without them, you’re just measuring dissolution in distilled water and calling it pharmacokinetics. And let’s not forget the f2 similarity factor - if it’s below 50, you’re not even in the game. Also, if your model’s R² isn’t >0.95, you’re wasting everyone’s time. This isn’t guesswork - it’s math.

Deepak Mishra November 23, 2025

OMG this is SO important!!! I just read this and my brain exploded!!! 😱 Level A = holy grail!!! Level C = maybe? Maybe not??!! And biorelevant media??!! I didn’t even know that was a thing!!! 😭😭😭 I’m telling everyone I know!! This is the future!!!

Rachel Wusowicz November 24, 2025

They say it’s 'science'... but who funds the validation studies? Who owns the algorithms? If AI is building these models, who’s auditing them? And what happens when the model says 'safe' but a patient dies because their gut flora was different? Who’s liable? The CRO? The FDA? The generic company? This isn’t progress - it’s a liability time bomb.

Vera Wayne November 26, 2025

This is such a thoughtful, clear breakdown. I’ve been trying to explain IVIVC to my team for months and this nails it. Seriously, save this page and share it with everyone in R&D. The part about starting early? So true. We waited until Phase 3 and it nearly killed our timeline. Don’t make our mistake.

Rodney Keats November 27, 2025

So let me get this straight - we’re replacing actual human data with a fancy dissolution curve? And you call that 'science'? Next they’ll replace clinical trials with a chatbot and call it 'AI-assisted approval'. At least back then, when we tested on people, we knew we were taking a risk. Now we’re just gambling with math and hoping no one dies. Brilliant.

Laura-Jade Vaughan November 28, 2025

✨ Level A = ✨ The Holy Grail ✨ of Generic Drug Approval 🌟 And biorelevant media? 🤯 It’s not just a trend - it’s the *only* way forward. Also, can we talk about how Teva is basically the superhero of this space? 💪 #IVIVC #PharmaLife #NoMoreHumanTrials

Jennifer Stephenson November 29, 2025

Level A IVIVC enables biowaivers. Requires robust dissolution and dense PK data. Non-biorelevant methods fail. Start early. Invest in expertise.

Segun Kareem November 29, 2025

Science is not just about saving money. It’s about dignity. For decades, we asked people to be guinea pigs so we could sell cheaper medicine. Now we’re using knowledge - real, hard-won knowledge - to protect them. This isn’t cutting corners. It’s lifting the burden. And that’s what true innovation looks like.